COMPANY NEWS

Essex Biotech's mid-2019 net profit increased by 31% year-on-year to HK$129 million

2019.08.12

Download

Hong Kong, 12 August 2019

Essex Bio-Technology Limited (“EssexBio” or the “Group”, Stock code: 1061) today announced the interim results for the six months ended 30 June 2019.

For the year ended 30 June 2019, the Group achieved a consolidated turnover of approximately HK$581.7 million, representing an increase of 3.6% over the corresponding period last year. Despite the marginal increase in turnover, the Group recorded a positive profit after tax of HK$129.6 million, an increase of 31.0% as compared to the same period of last year. The positive result is a testament to its effective internal reform of its sales and marketing organisation and strategies proactively taken since the fourth quarter of 2018.

The Group’s revenue is chiefly derived and denominated in Renminbi from its operations in the PRC. For the six months ended 30 June 2019, turnover presented in Hong Kong Dollars was jeopardised by around 6.7% due to the weakening of Renminbi during the period under review.

The weakening of Renminbi and changes of policies in the healthcare system in the PRC including the two invoicing system have directly impacted negatively the Group’s turnover to a marginal increase of 3.6% for the period ended 30 June 2019 as compared to the corresponding period of last year, which would otherwise have double-digit increment.

The turnover contribution by business line of ophthalmic and surgical products is represented as 43.0% and 57.0%, respectively.

Essex Bio-Technology Limited (“EssexBio” or the “Group”, Stock code: 1061) today announced the interim results for the six months ended 30 June 2019.

For the year ended 30 June 2019, the Group achieved a consolidated turnover of approximately HK$581.7 million, representing an increase of 3.6% over the corresponding period last year. Despite the marginal increase in turnover, the Group recorded a positive profit after tax of HK$129.6 million, an increase of 31.0% as compared to the same period of last year. The positive result is a testament to its effective internal reform of its sales and marketing organisation and strategies proactively taken since the fourth quarter of 2018.

The Group’s revenue is chiefly derived and denominated in Renminbi from its operations in the PRC. For the six months ended 30 June 2019, turnover presented in Hong Kong Dollars was jeopardised by around 6.7% due to the weakening of Renminbi during the period under review.

The weakening of Renminbi and changes of policies in the healthcare system in the PRC including the two invoicing system have directly impacted negatively the Group’s turnover to a marginal increase of 3.6% for the period ended 30 June 2019 as compared to the corresponding period of last year, which would otherwise have double-digit increment.

The turnover contribution by business line of ophthalmic and surgical products is represented as 43.0% and 57.0%, respectively.

- Surgical products recorded a total turnover of approximately HK$331.8 million and its reportable segment profit of HK$92.2 million, representing correspondently an increase of 13.3% and 59.2%, respectively. The performances were weighted down by the depreciation of Renminbi and changes of policies in the healthcare system in the PRC including the two invoicing system.

- The overall ophthalmic products contributed approximately HK$249.9 million and its reportable segment profit of HK$ 69.7 million representing correspondently a decrease of 6.9% and 4.3%, respectively. The negative performances were attributed to the depreciation of Renminbi and changes of policies in the healthcare system in the PRC including the two invoicing system.

During the period under review, the distribution and selling expenses were approximately HK$300.7 million as compared to the corresponding period last year of approximately HK$312.8 million, representing a decrease of 3.9%. In spite of the decrease in selling expenses, average turnover generated by each sales and marketing representative increased by 10.7% to approximately HK$444,000 from HK$401,000 for the corresponding period last year, reflecting significant improvement of the productivity for each salesperson and sales efficiency.

During the period under review, the Group has accomplished following business development milestones, namely:

During the period under review, the Group has accomplished following business development milestones, namely:

- Partial Divestment of MeiraGTx with A Net Gain of HK$ 18 million Recorded in OCI

For the period ended 30 June 2019, the Group partially divested its investment in MeiraGTx in the open market with a realised net gain of approximately HK$18.0 million. The gain was recorded in other comprehensive income instead of profit or loss. The remaining investment as at 30 June 2019 has a market value of approximately HK$26.8 million. This is the maiden divestment from its investment portfolio under the Enrichment Programme.

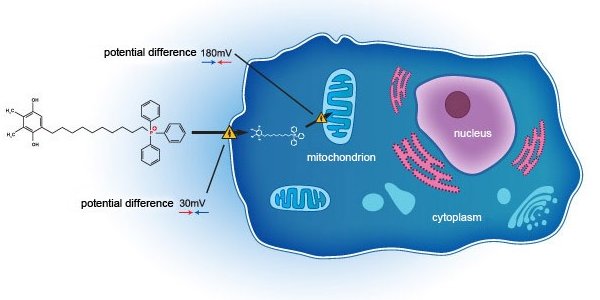

- Successfully Completed the First Phase 3 Clinical Trial of the SkQ1 for Dry Eye Disease

On 19 July 2019, the Group, together with Mitotech, announced the topline results from VISTA-1, the first Phase 3 Clinical Trial in U.S. FDA of a first-in-class drug SkQ1 for dry eye disease. Encouraged by the robust data on efficacy and safety shown in VISTA-1, the Group and Mitotech are discussing on taking the U.S. FDA Phase 3 Clinical Trial of the SkQ1 product to the next step i.e. second Phase 3 Clinical Trial.

- Investment in Antikor Biopharma

On 22 January 2019, the Group entered into a convertible loan agreement with Antikor , a UK-based biotechnology company specialising in the discovery and development of miniaturised antibody drug conjugates (ADCs) known as (fragment) FDCs, pursuant to which the Group subscribed for a convertible loan issued by Antikor in the principal amount of approximately US$0.4 million. For the furtherance of the strategic co-operation between the Group and Antikor, on 19 July 2019, the Group entered into the Subscription and Shareholders Deed with Antikor. Pursuant to the Subscription and Shareholders Deed, the Group agreed to subscribe for ordinary shares of Antikor at the aggregate consideration of up to US$3.1 million by way of up to five tranches, including the conversion of the Convertible Loan subscribed by the Group on 22 January 2019. Assuming all five tranches of the Subscription Shares are fully subscribed by the Group, the Subscription Shares will represent approximately 40.12% of the enlarged total issued share capital of Antikor on a fully diluted basis.

This strategic alliance with Antikor, a pioneer and innovator in ADC/FDC would enrich the Group’s research pipeline, especially in Oncology. The access to Antikor’s novel technology platform, enhances the Group’s experience in development, manufacturing and commercialisation of biologics, aligned with the Group’s long-term research and commercial strategy.

- Acquisition of 100% Equity Interest in Wuhan Adv. Dental Co.,Ltd.

On 1 April 2019, the Group acquired 100% equity interest in Adv. Dental at a consideration of approximately RMB1.2 million (equivalent to approximately HK$1.4 million). The major product being

manufactured and marketed by Adv. Dental is Carisolv, a product for the treatment of dental caries by using minimally invasive techniques.

The Group has cash and cash equivalent of HK$ 334.7 million as at 30 June 2019. The board of Directors is pleased to declare an interim dividend of HK$0.035 (For the six months ended 30 June 2018: HK$0.030) per ordinary share for the six months ended 30 June 2019.

粤公网安备 44049102496184号

粤公网安备 44049102496184号